Welcome to our comprehensive guide on leveraging the power of business voucher checks! In today’s fast-paced and competitive business environment, every opportunity to save money and maximize resources counts. One such opportunity lies in the strategic utilization of voucher checks. These versatile financial instruments offer a plethora of benefits, from discounts and rewards to enhanced supplier relationships and improved budget management. In this blog series, we’ll delve deep into understanding voucher checks, exploring various strategies to optimize their benefits, and providing practical tips for businesses to make the most out of this valuable resource.

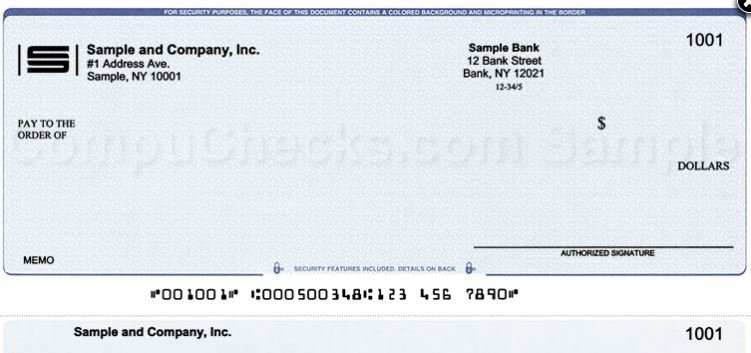

Understanding Your Voucher Check

Understanding your voucher check is essential for leveraging its benefits and strategically allocating your budget. Voucher checks are versatile financial instruments that offer various advantages to businesses. By comprehending the terms and conditions, you can exploit discounts, cashback offers, or other incentives associated with their use. Effective utilization involves aligning your expenses with your business objectives and financial goals.

This requires careful planning and consideration of where to allocate funds for maximum return on investment. Whether it’s paying suppliers, covering operational costs, or investing in growth opportunities, strategic budget allocation ensures optimal resource utilization. Additionally, monitoring expenditure against budgeted amounts helps in identifying areas for improvement and maintaining financial stability. Overall, understanding and leveraging your business voucher check benefits contribute significantly to enhancing your business’s financial efficiency and success.

Leveraging Voucher Check Benefits

Leveraging voucher check benefits entails utilizing discounts, rewards, and incentives associated with their use to maximize cost savings and value for your business. By strategically timing purchases or transactions, you can capitalize on special offers or cashback opportunities, effectively reducing expenses. Furthermore, leveraging voucher checks can foster stronger relationships with suppliers or partners, potentially leading to preferential treatment or better terms in the future. Overall, optimizing voucher check benefits enhances your purchasing power and boosts your bottom line.

Strategic Budget Allocation

Strategic budget allocation involves thoughtfully distributing financial resources to align with your business goals and priorities. By carefully assessing your company’s needs and objectives, you can prioritize spending in areas that yield the highest returns or support key initiatives. This may include allocating funds for marketing campaigns to drive growth, investing in technology to enhance efficiency, or allocating resources for staff training to improve productivity. Strategic budget allocation enables you to optimize resource utilization, minimize waste, and ensure that every dollar spent contributes effectively to your business’s success and sustainability.

Maximizing Discounts and Offers

Maximizing discounts and offers involves actively seeking out opportunities to reduce expenses and increase savings for your business. By staying informed about promotional deals, loyalty programs, and special offers from suppliers or vendors, you can capitalize on significant cost savings. Negotiating bulk discounts or taking advantage of seasonal promotions can also help maximize your purchasing power. Additionally, leveraging business voucher check benefits and utilizing cashback incentives can further enhance your savings. By consistently seeking out and utilizing discounts and offers, you can effectively lower your overall expenses and improve your business’s financial health.

Building Supplier Relationships

Building strong supplier relationships is crucial for ensuring smooth operations and obtaining favorable terms for your business. By fostering open communication, trust, and mutual respect with your suppliers, you can establish long-term partnerships that benefit both parties. This includes paying invoices on time, providing clear feedback, and resolving any issues promptly. Strong supplier relationships may also lead to preferential pricing, priority access to inventory, or collaborative opportunities for innovation. Ultimately, investing in building strong supplier relationships enhances reliability, reduces risks, and creates a competitive advantage for your business in the marketplace.

Tracking and Analyzing Expenditure

Tracking and analyzing expenditure is essential for maintaining financial control and making informed business decisions. By diligently recording all expenses and categorizing them appropriately, you gain insights into your company’s spending patterns and identify areas for optimization or cost reduction. Utilizing accounting software or financial tools can streamline this process and provide real-time visibility into your financial status. Furthermore, conducting regular expense reviews and variance analyses allows you to spot trends, assess the effectiveness of your budget allocations, and adjust strategies as needed to ensure financial stability and profitability in the long run.

Employee Incentives and Rewards

Offering employee incentives and rewards is crucial for fostering motivation, productivity, and loyalty within your workforce. Recognizing and rewarding outstanding performance encourages employees to excel in their roles and contributes to a positive work environment. Whether through monetary bonuses, additional time off, or other perks, incentivizing employees aligns their efforts with organizational goals and enhances overall job satisfaction. Furthermore, well-designed incentive programs can attract top talent, reduce turnover rates, and ultimately drive business success.

Security Measures and Fraud Prevention

Implementing robust security measures and fraud prevention strategies is imperative for safeguarding your business’s financial assets and sensitive information. Utilizing encryption technology, firewalls, and multi-factor authentication helps protect digital systems and prevent unauthorized access. Additionally, conducting regular audits, implementing internal controls, and providing staff training on cybersecurity awareness can mitigate the risk of fraud and data breaches. By prioritizing security measures, businesses can maintain trust with customers, preserve their reputation, and minimize financial losses associated with cyber threats.

Sustainability Initiatives

Embracing sustainability initiatives is essential for businesses to minimize their environmental footprint and contribute positively to society. Implementing eco-friendly practices such as reducing waste, conserving energy, and sourcing from sustainable suppliers demonstrates corporate responsibility and enhances brand reputation. Additionally, investing in renewable energy, implementing recycling programs, and supporting community initiatives further aligns businesses with sustainable development goals. By integrating sustainability into their operations, businesses can not only mitigate environmental impacts but also attract environmentally-conscious consumers and gain a competitive edge in the market.

Future Planning and Adaptation

Engaging in future planning and adaptation is crucial for businesses to remain agile and resilient in an ever-changing market landscape. Anticipating market trends, technological advancements, and shifting consumer preferences allows businesses to proactively adjust strategies and capitalize on emerging opportunities. This may involve investing in research and development, diversifying product offerings, or expanding into new markets. Furthermore, fostering a culture of innovation and continuous learning enables organizations to stay ahead of the curve and adapt swiftly to disruptions. By embracing future planning and adaptation, businesses can position themselves for sustained growth and long-term success.

Conclusion

In conclusion, maximizing the benefits of your business voucher check requires strategic planning, diligent execution, and a proactive approach. By understanding its potential, leveraging discounts, building supplier relationships, and tracking expenditure, businesses can optimize their financial resources and enhance their bottom line. Moreover, prioritizing employee incentives, security measures, sustainability initiatives, and future planning ensures long-term viability and success in today’s dynamic business landscape. Embracing these strategies empowers businesses to thrive and adapt effectively to evolving challenges and opportunities.